Mon – Fri: 8.30 AM – 4.00 PM

E-mail: nasvet@generali-investments.si

Choose your financial adviser and arrange an appointment

Find your nearest office.

Mon – Fri: 8.30 AM – 4.00 PM

E-mail: nasvet@generali-investments.si

Choose your financial adviser and arrange an appointment

Find your nearest office.

Generali Investments, Management Company LLC (Generali Investments, družba za upravljanje, d.o.o.), Dunajska cesta 63, Ljubljana, manages the Generali Umbrella Fund and its subfunds Generali Galileo, Mixed Flexible Fund; Generali Rastko Europe, Equity; Generali Bond – EUR; Generali MM, Money Market – EUR; Generali First Selection, Fund of Equity Funds; Generali South Eastern Europe, Equity; Generali New Markets, Equity; Generali Raw Materials and Energy, Equity; Generali Technology, Equity; Generali Vitality, Equity; Generali India – China, Equity; Generali Latin America, Equity; Generali Eastern Europe, Equity; Generali Global, Equity; Generali America, Equity; and Generali Corporate Bonds – EUR. The Umbrella Fund Prospectus Including the Fund Rules, the Key Information Documents (KID), and the latest published annual and semi-annual reports of the Umbrella Fund in the Slovenian language are available to investors free of charge at the Company’s headquarters and subscription offices, and in electronic format on the website www.generali-investments.si.

Before making any investment decision, please read the Key Information Document and the Umbrella Fund Prospectus Including the Fund Rules, which contain detailed and binding information on each fund. These two documents and the latest published audited annual and semi-annual reports in the Slovenian language are available to investors free of charge at the Company’s headquarters and subscription offices. They are also available in electronic format on the website www.generali-investments.si, along with other data and information about each fund. By investing in a subfund, the investor acquires units in the fund and not directly units in an underlying asset in which the fund invests. The subfunds are actively managed and are not managed in reference to an index. Indices are only used to compare the performance of the fund.

Past performance does not predict future returns. Variations in the fund unit values largely depend on the situation in capital markets. As unit values may grow or fall, future returns may be higher or lower than past returns. There is a likelihood that investors may not get back all the money invested in a fund during the saving period. Some subfunds may not be suitable for investors who intend to withdraw their money within less than 5 years. Complete information on the risks can be found in the Generali Umbrella Fund Prospectus Including the Fund Rules and in the Key Information Document. The computations exclude entry and exit charges and taxes that may be levied on the investor and could decrease the presented rate of return; they depend on the personal situation of each investor and may change in the future. The maximum entry charges for Generali Galileo, Generali Rastko Europe, Generali South Eastern Europe, Generali New Markets, Generali Raw Materials and Energy, Generali Technology, Generali Vitality, Generali India – China, Generali Latin America, Generali Eastern Europe, Generali Global and Generali America amount to 3%. The maximum entry charges for Generali Bond, Generali First Selection and Generali Corporate Bonds amount to 2%. Higher payments into a fund are subject to lower entry charges in accordance with the scale of charges published on the website www.generali-investments.si. Generali MM has no entry charges. The maximum exit charges amount to 2.5% and are only levied on payments from a saving package if less than 5 years have elapsed since the initial contribution into a package. Generali Bond, Generali MM and Generali Corporate Bonds have no exit charges. Generali America is not included in a savings package and therefore does not have any exit charges. Up to 100% of assets of Generali MM may be placed in money market instruments issued or guaranteed by the European Union, the national, regional and local administrations of the Member States or their central banks, the European Central Bank, the European Investment Bank, the European Investment Fund, the European Stability Mechanism, the European Financial Stability Facility, a central authority or central bank of a third country, the International Monetary Fund, the International Bank for Reconstruction and Development, the Council of Europe Development Bank, the European Bank for Reconstruction and Development, the Bank for International Settlements or any other relevant international financial institution or organisation to which one or more Member States belong. Investors are warned that Generali MM money market fund is not a guaranteed investment, that an investment in a money market fund is different from an investment in a deposit because, unlike a deposit, it carries the risk of a change in the principal amount; that a money market fund does not rely on external support for guaranteeing its liquidity or stabilising its unit value; and that the risk of loss of the principal is borne by the investor. Up to 100% of assets of Generali Bond may be placed in bonds of a single issuer being a state, a local or regional community, or an international organisation. At least 90% of assets of Generali First Selection are placed in units of other funds.

Fund statistics are published on the website www.generali-investments.si. Returns until 1. 2. 2023 for Generali Bond, Generali Rastko Europe, Generali New Markets, Generali Materials and Energy, Generali Technology, Generali Vitality, Generali India – China, Generali Latin America, Generali Global, Generali America and Generali Corporate Bonds, until 1. 1. 2020 for Generali MM and until 17. 4. 2016 for Generali Galileo, Generali First Selection and Generali South Eastern Europe were achieved under conditions that no longer apply.

An investment in any of the Generali Umbrella Fund subfunds is not a banking service and is therefore not included in the guarantee scheme for deposits of banks and savings banks.

Tolar amounts of the fund unit values were converted into euros using the Bank of Slovenia’s mean exchange rate on the valuation day. The tolar amounts of fund unit values in the period before the euro changeover on 1 January 1999 were converted according to the Bank of Slovenia’s mean exchange rate applicable for the ECU.

Generali Global, Equity, emerged from the transformation of the KD Equity Income Mutual Fund into a subfund, whilst the latter transformed from the KD ID, Equity Investment Company, plc, on 12 April 2011. Details of the investment company and its business operations before the transformation into a mutual fund are available on www.generali-investments.si.

On 14 January 2013, the Management Company merged the following subfunds:

| Merged fund: | Exchange rate | Acquiring fund |

|---|---|---|

| KD New energy, Equity | 0,0864392785 | Generali Raw Materials and Energy, Equity |

| KD North America, Equity | 0,4909831256 | Generali Galileo, Mixed Flexible Fund |

| KD Finance, Equity | 0,1049474021 | Generali Galileo, Mixed Flexible Fund |

| KD EM Infrastructure and Construction, Equity | 0,2600770229 | Generali New Markets, Equity |

On 3 October 2022, the Management Company merged the Generali Eastern Europe, Equity subfund with the Generali New Markets, Equity subfund, at the exchange rate of 0.099552669766.

| Marged and dissolved fund: | Exchange rate | Receiving fund |

|---|---|---|

| Generali Eastern Europe, Equity | 0,099552669766 | Generali New Markets, Equity |

On 9 June 2016, the Management Company took over the management of nine subfunds of the ILIRIKA Umbrella Fund, merging them, on 3 October 2016, with the Generali Umbrella Fund subfunds (at that time KD Umbrella Fund).

Details on the operations of the subfunds dissolved through the merger are available on the website www.generali-investments.si.

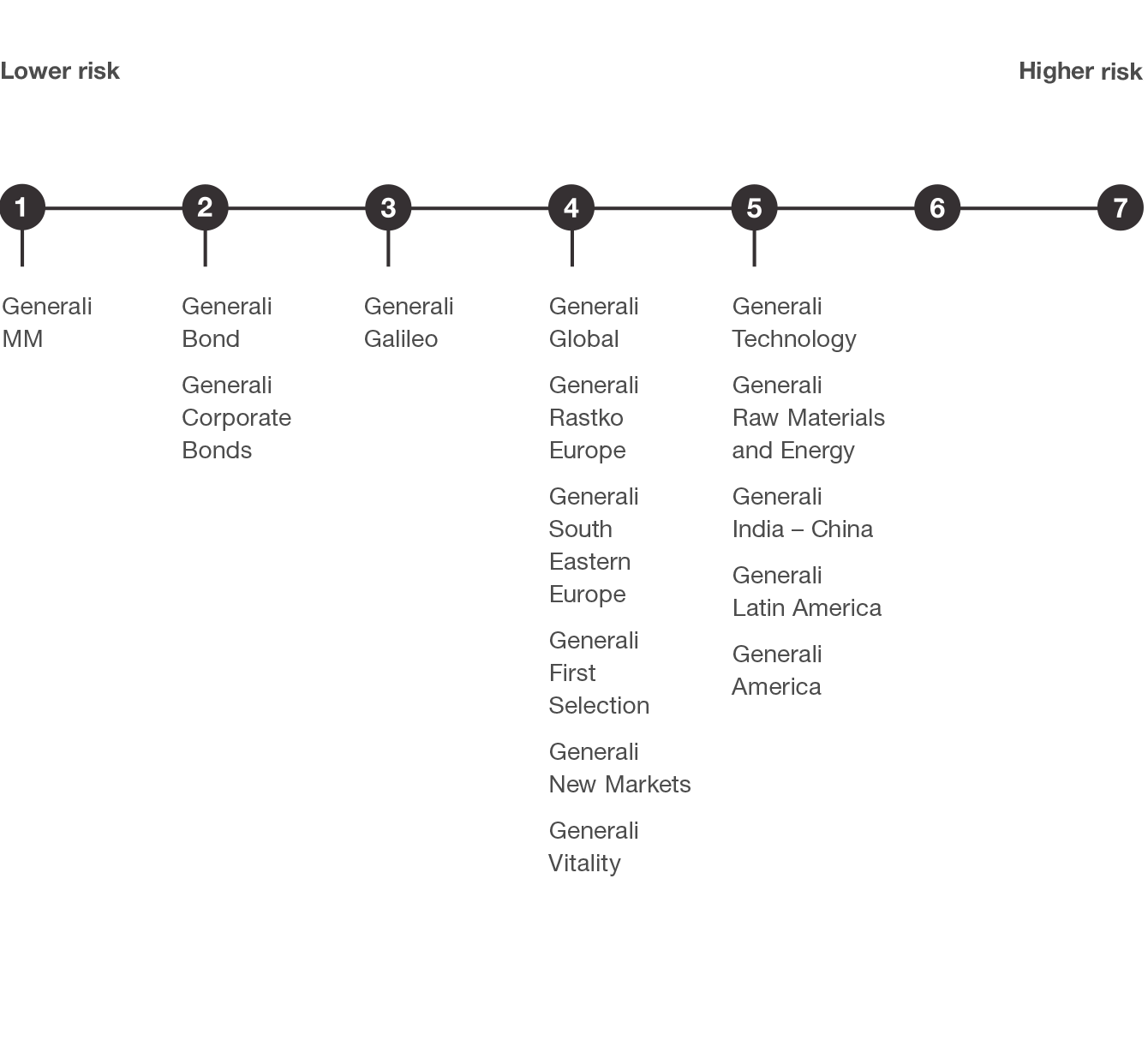

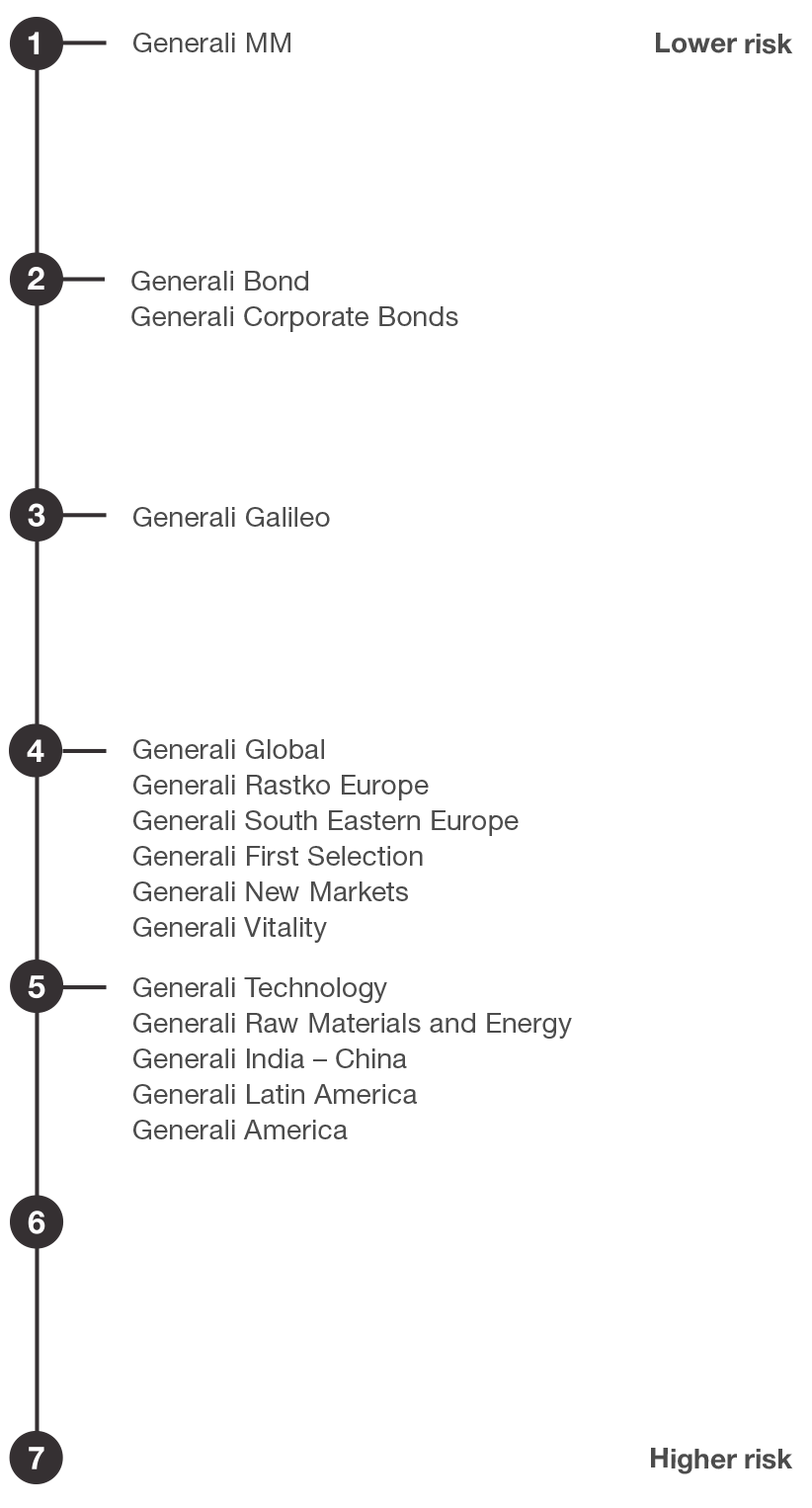

* The summary risk indicator is a guide to the level of risk of a fund compared to other products. It shows how likely it is that the product will lose money because of movements in the markets or because we are not able to pay you. The summary risk indicator is based on the estimate of fluctuations in unit values. The summary risk indicator may change depending on the actual performance of a subfund in the future. The lowest category does not mean a risk-free investment. The fund does not include any protection from future market performance or market risk so you could lose some or all of your investment.

The funds are classified under different risk indicators, with the following numerical scale:

• indicator 1 out of 7 represents the lowest risk class, and the unit value of a fund classified as 1 may be exposed to the lowest price fluctuations, this rates the potential losses from future performance at a very low level, and poor market conditions are very unlikely to impact our capacity to pay you;

• indicator 2 out of 7 represents a low risk class, and the unit value of a fund classified as 2 may be exposed to low price fluctuations, this rates the potential losses from future performance at a low level, and poor market conditions are very unlikely to impact our capacity to pay you;

• indicator 3 out of 7 represents a medium-low risk class, and the unit value of a fund classified as 3 may be exposed to medium-low price fluctuations, this rates the potential losses from future performance at a medium-low level, and poor market conditions are unlikely to impact our capacity to pay you;

• indicator 4 out of 7 represents a medium risk class, and the unit value of a fund classified as 4 may be exposed to medium price fluctuations, this rates the potential losses from future performance at a medium level, and poor market conditions could impact our capacity to pay you;

• indicator 5 out of 7 represents a medium-high risk class, and the unit value of a fund classified as 5 may be exposed to medium-high price fluctuations, this rates the potential losses from future performance at a medium-high level, and poor market conditions will likely impact our capacity to pay you.

The risk indicator assumes you keep the fund for at least 5 years (Generali Galileo, Generali Rastko Europe, Generali First Selection, Generali South Eastern Europe, Generali New Markets, Generali Raw Materials and Energy, Generali Technology, Generali Vitality, Generali India – China, Generali Latin America, Generali Global, Generali America), 3 years (Generali Bond and Generali Corporate Bonds), or 30 days (Generali MM), respectively.

Enter your contact details and select a FREE appointment at our office, or provide your personal details and we will contact you to arrange an appointment.

* Fields marked with an asterisk are required.

Bogatite svoje znanje o varčevanju v vzajemnih skladih s pomočjo naših nasvetov za vlagatelje in aktualnih vsebin. Prijavite se na e-novice in prejmite uporabne vsebine v vaš e-nabiralnik.

Geza Norčič

institutionals@generali-investments.si

Notifications